TAXATION OF FIXED INCOME INSTRUMENTS

The government of India and the banking system offers individual investors the opportunity to park their money in a number of safe and relatively liquid financial instruments. The direct and sometimes indirect sovereign guarantee on these instruments make them a very attractive proposition for investors who are either risk averse or are seeking downside protection for creating a well-diversified portfolio.

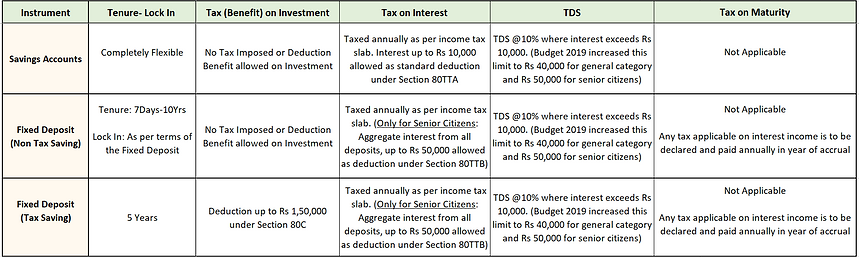

These instruments by their very nature promise a relatively safe and stable source of income-returns. However, to understand their suitability and maximize the benefits they offer, it is essential to understand the tenure options and taxation implications associated with each of these instruments. Below is a snapshot of the liquidity (lock in) and taxes applicable on some of the most popular instruments (updated as per Budget 2019).

Bank Based Saving Instruments

Government of India Backed Saving Schemes

Post Office Saving Schemes

Retirement Based Savings Scheme (Government Backed)